Breaking Down Why Customer Feedback is Important for the FinTech Industry

Some time ago, we covered the key metrics that a Product Manager in a fintech organization should make a top priority when determining their KPIs, breaking them down into five groups: Session-based data, Customer Feedback, Technical Metrics, Action Stats, and Revenue. With that in mind, we conducted a series of surveys on LinkedIn, asking PMs in the fintech industry which of those groups were the most important for them while running digital product analytics. Surprisingly, 56% of PMs said they cared about Customer Feedback the most, making us wonder…

Why is Customer Feedback so crucial?

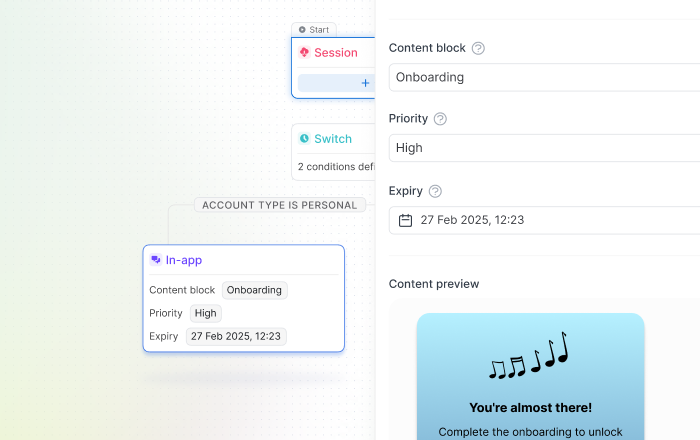

Okay, we actually knew that feedback metrics were going to be important for PMs. After all, we have been reporting on ways to incorporate feedback into wider strategies and, as a product analytics platform, we have added new features for collecting user feedback. We were not expecting, however, such disproportionate results favoring Customer Feedback.

So let’s explore some possible reasons.

Industry Volatility

The fintech industry (note that we’re including digital banking, payment technologies, blockchain, and cryptocurrency trading within the term) has been a rollercoaster in recent years, even before the Covid-19 pandemic started. New and disruptive technologies emerged and created new grounds for growth that had been previously unknown, so there was no rule book or benchmark to understand the end-user sentiment over the usage or performance of these products. Thus, fintech product managers need first-hand feedback from users.

Fast-Paced Markets

Now yes, the pandemic. The forced mass migration to digital environments happening at the same time around the world created a lot of pressure on the existing fintech resources and fostered new market players, both of which had to convince users to deposit — pun intended — their trust with them and not the ever-growing number of competitors. Basically, the higher the competition, the more you will need to care about what users are saying about you.

Lack of Product Knowledge

Given what was mentioned above, new users everywhere started relying on fintech products, even without fully understanding how to use them or how they operated. A steep learning curve in a context of forced need is a recipe for high levels of frustration, which most likely be reflected in words from angry — or happy — customers.

Loyalty via User Feedback

Whatever the combination of metrics applicable to each product, we all know that it’s more cost-effective to retain users, ensure their trust, and keep them loyal than to go out and find more users or customers. At the end of the day, it all boils down to finding more ways to gain user loyalty.

Start capitalizing on user loyalty today! Chat with us or get your personalized demo.

Back to that blog article, we covered some metrics that needed to be in any PM’s mind when thinking about customer feedback:

- Median Customer Rating: average response rate for responded ratings sent on a 1-to-5 basis.

- Survey Response Rates: total responses received to your surveys, expressed as a percentage of the total number of users who received your survey.

- Average Net Promoter Score®: a standardized metric calculated by subtracting the percentage of detractors from the percentage of promoters.

Obviously, there are plenty more, but understanding how these play into effective ways of keeping customers happy will make all the difference.

Considering the reasons listed in the previous section, in the fintech environment, determining metrics that track user perception can make or break the business. Given the speed at which the industry grows and its reliance on mobile devices, customer feedback needs to be a top priority because bad reviews — or a bad rep, in general — will make a big dent in brand perception.

Where Do Analytics Come In?

Metrics like the ones above give you a real-time pulse of user sentiment and you must keep an eye on them all the time. Doing so will enable, among other things, faster damage control in the event of outages, bugs, data breaches, and a long list of etceteras. Let’s review a couple of scenarios:

Payment Tech App with Bugs

Truth is, given the speed and volatility of the market, some products may still have bugs after they hit app marketplaces.

To avoid that situation, product analytics for mobile devices allow you to identify issues in the performance of certain elements of the app, which you can discover even without users reporting them. If you track the step-by-step progression of users through the app and see that they tend to take too long or stop at a certain point, then maybe that’s something to look into. If on top of that, you discover that this slow-down occurs to users with certain devices or in certain networks, you might be looking at a bug.

How do you make sure? Group those users with the issue and send them a survey, inquiring about their experience and letting them describe any issues. Then, create a cohort based on shared results and target them with push notifications to keep them informed about how you are fixing the issues: you’ll make those users feel valued and revert a negative impression before it’s too late and they delete the app and/or leave a bad review.

EBank with An Unscheduled Service Outage

Crashes are one of the most dangerous occurrences for an eBank app. You don’t just stop customers from accessing their money, fix the issue, and pretend as if nothing happened. Identify crashes, rate their severity (or how much revenue they are costing you), get real-time alerts, and take immediate action. That is usually business-as-usual, but what about feedback?

Keep track of your feedback metrics before and after crashes, particularly of your NPS®, ensuring that you identify users that show large drops in satisfaction levels. Then, reuse that information for your outreach and promotional campaigns as well as apply it to set business processes and user notification processes to mitigate the long-term effects of the crash.

Paytech Startup Undergoing Rapid User Acquisition

When your product is growing fast, it can become hard to scale your metrics and simplify your feedback collection tools. Deliver straightforward tools like 1-to-5 ratings or NPS® surveys, with which end-users can quickly interact and move on. Track retention trends and automatically tailor the timing and the type of question you will ask based on your segmented user base.

But also, when you’re growing fast, chances are that your customers know about it. So keep them in the loop, and combine the results you get from feedback tools with the type of notifications being sent out, possibly even letting them know you implemented something they suggested.

Key Takeaways

There is always room for growth and improvements for apps and websites in the finance and fintech industries, especially given the speed at which the industry evolves. Which is why product analytics needs to keep pace with this growth. Sometimes some rigid platforms might not match your needs as you grow, pivot, or expand. Thus, you must consider adaptable platforms that help you scale your product analytics insights as new users come in, new features are rolled out, and new avenues of revenue are tapped. Ideally though, those platforms will also enable you to track your users’ feedback and action upon those insights from a central place, to remain ahead of the newer and shinier fintech competitor that is always around the corner.